Trends in the Automotive Glass Market

In 2022, the global automotive glass market achieved a valuation of USD 30.8 billion, with projections indicating a steady compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. The industry’s growth is spurred by a growing emphasis on lightweight vehicles, driven by escalating concerns over harmful emissions from automobiles and their adverse environmental impact. The automotive sector’s focus on incorporating glass components has been fueled by the need for sustainable practices. According to the International Organization of Motor Vehicle Manufacturers (OICA), the global production of automobiles surged to 85.02 million vehicles in 2022. This notable increase is primarily attributed to robust manufacturing activities, notably in countries like China and India, where governmental initiatives regarding motor vehicle regulations have played a significant role in fostering automotive development.

The automotive industry is undergoing a technological revolution, prompting market players to introduce advanced products tailored to modern vehicle designs. AIS Glass in India exemplifies this trend, providing innovative solutions like solar green glass and acoustic PVB for the Toyota Yaris and a 2.8mm backlight for the new Wagon R in FY 2018-2019.

The surge in electric vehicle production and the integration of new display and battery technologies are anticipated to positively impact the demand for automotive glass. Dutch company Lightyear’s electric car prototype, the Lightyear One, features integrated solar cells beneath the roof and hood, recharging directly from the sun.

While technological advancements continue, challenges arise concerning raw material availability and cost structure. Soda ash, a key raw material, has experienced price hikes due to limited supply. Manufacturers are scaling up production capacities to meet demand from key markets like automotive glass.

The focus on fuel efficiency and emissions reduction has led to increased production of lightweight and electric vehicles, driving demand for automotive glass. Despite an overall decline in vehicle production, the demand for automotive glass remains steady, supported by the rise in commercial vehicle and electric car production.

Technological innovations extend beyond vehicle advancements to glass technologies, such as Gentex Corporation’s dimmable and display glass. Sunroof demand, driven by consumer luxury preferences, contributes to the growth of the automotive glass industry.

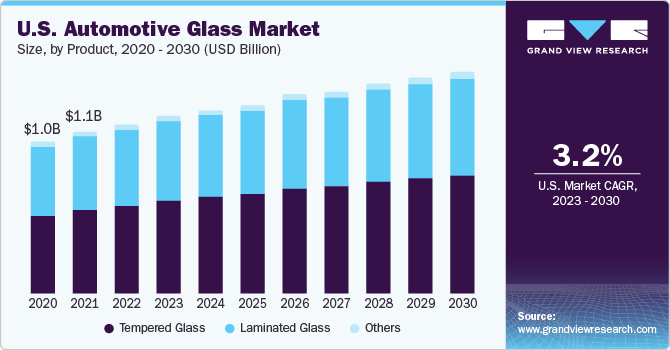

However, high manufacturing costs pose a challenge, particularly with over 90% of automotive glass produced through the capital-intensive float glass process. The tempered glass segment dominates the market, accounting for 59.1% of revenue in 2022, with its strength, cost-effectiveness, and suitability for windows and backlights. The laminated glass segment is expected to grow rapidly, driven by safety features and applications in windscreens and sunroofs. Companies like Volvo, Ferrari, and Tesla incorporate laminated glass in cars with panoramic sunroofs, further propelling segment growth.

In response to rapidly evolving consumer demands, the automotive industry is witnessing continuous technological advancements. The transition from traditional fuel-based to electric vehicles and manual to automatic transmissions reflects these dynamic changes. Innovations in automotive glass technology, such as Gentex Corporation’s dimmable and display glass, showcase the industry’s commitment to enhancing driving experiences.

Solar technology is becoming a prominent feature in electric vehicles, with companies like Lightyear introducing prototypes like the Lightyear One, equipped with integrated solar cells. These solar panels not only contribute to sustainable energy practices but also enhance the range of electric vehicles.

The emphasis on fuel efficiency and reduced emissions has led to a surge in lightweight and electric vehicle production, fostering a consistent demand for automotive glass. Despite an overall decline in vehicle production, the automotive glass industry remains resilient, driven by the increasing manufacturing of commercial vehicles and electric cars.

Consumers’ growing penchant for luxury has steered automotive manufacturers toward innovations, particularly in sunroof systems. The incorporation of either built-in or optional sunroof systems in mid and premium car segments propels the demand for automotive glass, aligning with consumer preferences for enhanced driving experiences.

While technological progress continues to shape the automotive glass landscape, manufacturing costs remain a significant challenge. The float glass process, responsible for over 90% of the world’s automotive glass, demands substantial capital investment, making profitability contingent on operating at high capacity utilization.

Product-wise, the tempered glass segment stands out, capturing 59.1% of the revenue share in 2022. Its popularity stems from attributes like low cost, high strength, and robustness, making it the preferred choice for windows and backlights. On the other hand, the laminated glass segment is poised for rapid growth, boasting safety features that keep it intact even after accidents, thereby ensuring passenger safety. Volvo, Ferrari, and Tesla’s utilization of laminated glass in cars with panoramic sunroofs underscores its increasing prominence in the market.

As automotive glass continues to evolve in tandem with broader industry trends, innovation and adaptability remain key drivers in meeting consumer expectations and regulatory requirements.